On October 29, 1929, the collapse of the New York Stock Exchange triggered the Great Depression. In a few days, investors lost almost $30 billion. The country’s banks and companies went bankrupt, and a large proportion of Americans were soon unemployed. The United States authorities were careful not to intervene and hoped that the economy would recover after the fall. At the same time, the attempt to support domestic production has spread the recession around the world.

Since the early 1920s, the American economy has been plagued by investment fever. In the pursuit of a quick payday, people and businesses spent all available credit money on purchasing valuable securities. The lack of clear regulation in the market led to the creation of one of the largest financial pyramids in the history of the world economy. The collapse of the bubble was only a matter of time, and from 24 to 29 October 1929, the United States stock market collapsed. The consequences of the collapse plunged the country into a prolonged economic crisis. That is exactly how the Great Depression began exactly 90 years ago.

According to the United States National Bureau of Economic Research, from 1920 to 1924 the Fed lowered its base rate from 7% to 3%. This measure has traditionally stimulated business activity in the country and economic growth in general: credit is cheaper and domestic demand and investment are increasing. From September 1924 to February 1928, the Federzerw rate remained in the range of 3-4% per annum.

Cheaper credit and better investment conditions triggered a booming uncontrolled growth of the stock market. The stock market became fashionable for Americans, and more and more citizens sought to get rich by becoming shareholders.

As a result, there was a marked increase in speculation in the market and the prices of financial assets far exceeded their real value. To make matters worse, the United States did not yet have clear legislation to prevent financial bubbles.

The crash was preceded by a speculative boom in the mid-1920s, during which millions of Americans invested in stocks. The growing demand for securities inflated stock prices, attracting more and more investors who wanted to get rich. Moreover, to support the price drive, Americans began to invest in equities on credit rather than on personal savings.

READ: Crazy Empire State Building: Worker Pictures and History

From the spring of 1928, Federerov began to increase the rate steadily, and in October 1929 the figure reached 6% per annum. This tightening of monetary policy is intended to prevent the economy from overheating. For example, higher rates increase the cost of borrowing for American businesses and reduce overall economic activity in the country.

People standing at the New York Stock Exchange on «Black Thursday» October 24, 1929

On October 24, the first wake-up call for the American economy came in, with stock prices plummeting. At the New York Stock Exchange, the Dow Jones index fell 26%, from 326 to 272. The market panicked and investors sold nearly 13 million securities in one trading session. This day has entered the history of the United States as «Black Thursday».

On Friday, the quotations tried to recover, but on Monday the panic intensified, and on Tuesday, 29 October, Wall Street collapsed. The Dow Jones index toppled to 212 points, and the total loss to investors reached $30 billion.

In a few days, about 30 million shares were sold. The value of the securities collapsed, bankrupting millions of investors. The stock market panic caused the market to fall by almost 40% in less than a week, and its value falls by $30 billion. That’s more than the United States government has spent in the entire First World War.

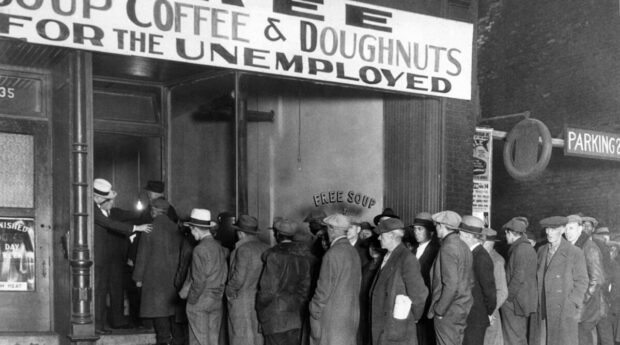

Huge financial losses among the population have significantly reduced consumption in the country. American firms were unable to sell their goods on the same scale. Companies began to reduce production and staff. So, following the loss of money, Americans began to lose their jobs.

READ: History of New York: 100 years ago and now

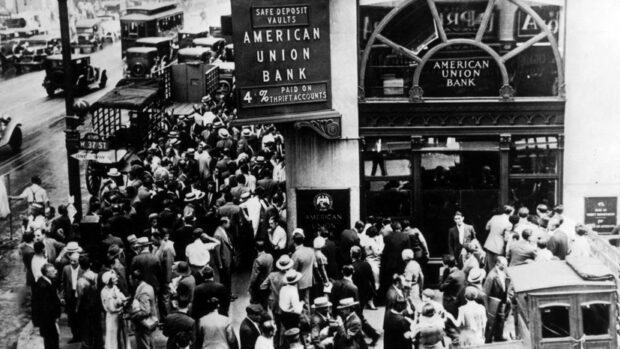

After the collapse of the stock market, American banks along with ordinary citizens lost their investments. Moreover, the poor have been actively withdrawing the remaining bank deposits. As a result, credit institutions had no money left to meet their obligations, which triggered a wave of bankruptcies.

In the first three years of the Great Depression, 4,835 banks went bankrupt in the U.S. Combined, these organizations deposited $3.2 billion in deposits.

Line of unemployed people for free soup and coffee with donuts

Interestingly, at the time of the onset of the Great Depression, there was no such thing as «gross domestic product» (GDP) in the world economy. The first measurements of this indicator were presented almost five years after the collapse of Wall Street. In the summer of 1934, the United States Department of Commerce published the report «National Income, 1929-1932».

The paper was written by Russian-American economist Simon Kuznets. Between 1929 and 1932, he estimated that US national income more than doubled, from $83 billion to $39.4 billion.

As the US Bureau of Economic Analysis later estimated, the US GDP recession peaked in 1932. The country’s economy shrank by nearly 13%, and the Dow Jones index failed to reach 47 points.

During the Great Depression, agricultural production was a key sector of the American economy. As of 1930, agriculture accounted for almost 22 percent of jobs and about 7.7 percent of the country’s GDP. The United States Department of Agriculture provides such data.

READ: 10+ Incredible Posters From The History Of New York City

Meanwhile, the low purchasing power of the population has led to a drop in agricultural prices. As a result, in the first few years of the crisis, the volume of production in the industry more than halved. According to the United States Bureau of Economic Analysis, from 1929 to 1932, the corresponding figure fell from $13 billion to $5.8 billion.

To help farmers and American companies as a whole, in 1930 the United States passed the Smoot-Hawley Act, which increased duties to 40% on imports of almost 20,000 foreign products. The United States enacted the Smoot-Hawley Act. It was assumed that a reduction in the share of foreign products in the United States market would stimulate domestic production, both industrial and agricultural.

The virtual closure of the American market was a blow to European manufacturers. As a result, United States trading partners began to retaliate or withdraw altogether from Washington. Eventually, American companies lost consumers abroad, and the economy worsened.

According to the United States Bureau of Economic Analysis, from 1929 to 1932, American trade collapsed almost threefold. Imports fell from $5.5 billion to $1.9 billion, and exports fell from $6 billion to $1.9 billion.

After the stock market crash in 1929, the Fed began to gradually reduce interest rates again. In December 1930 the rate reached 4.5%, in July – 2.5%, and by June 1, 1931 – 1.5% per annum. But the regulator’s actions could not stop the crisis.

The Fed’s efforts were not enough to restore investor confidence and optimism in the long run. Moreover, the US government’s inaction has amplified the impact of the financial crisis on the real economy.

The US leadership followed a policy of non-interference and, in the early stages of the crisis, did not take radical steps to extricate the country from the depression. As President Herbert Hoover believed at the time, the market economy would eventually recover on its own.

Economic depression cannot be cured by legislative and executive decisions. The economy itself should heal its wounds with the help of its own «cells» – producers and consumers themselves.

Roosevelt is credited with renouncing the so-called gold standard. Previously, the dollar was directly tied to a fixed number of dragmethalls. Similar practices existed around the world. The state could issue only a certain amount of money, commensurate with the country’s gold reserves.

In 1933, Washington untied the dollar from the gold and allowed the national currency to float freely. As a result, the dollar began to weaken sharply, and US producers gained a number of trade advantages. For example, American output has fallen sharply abroad, and foreign goods have risen significantly in the United States. Subsequently, other countries also began to abandon the gold standard.

When an economy falls, you have to try to help it through all channels, including export channels, but it was almost unavailable when the gold standard was in force – everybody wants to lower the value of their currencies, which is impossible. As a result, the countries hardest hit by the Great Depression were those that had been dragging their feet in abandoning the gold standard for a long time. France and Belgium were the first countries to do so, but they did not do so until about 1935, as opposed to Britain, which ceased to attach gold to gold in 1931.

In 1936, US exports rose to $3 billion, GDP growth accelerated to 12.9%, and unemployment fell to 13%. At the same time, the economy remained under pressure: in 1937, US gross domestic product grew by only 5.1%, and in 1938, it fell again by 3.3%.

The US economy was able to return to growth only with the outbreak of World War II, in which the United States again did not fight in its territory, but used land leasing and collateral lines to provide commercial support to its European allies.

The world’s macroeconomic paradigms have changed many times since 1945, and it is probably only in the 1980s that the world came to a good understanding of what to do and how to do it. From then on, the Great Tranquillity began, which lasted until 2008 and was accompanied by low fluctuations in economic growth and low inflation. And this, of course, is a consequence of the Great Depression – it has changed the way we think about reality very much.

Like us on Facebook for more stories like this: